We are halfway through 2016 and, as technology rapidly progresses, the expectation for financial leaders to be practicing forward-thinking driven business is growing. It’s easy to fall into a habit of valuing historical data over forward-looking information. So how can you go from being historically-minded to forward thinking?

First things first… Would you drive a car only looking in the rear view mirror?

So why would you drive your company only looking backwards at historical information?

There are two ways financial leaders can use historical information:

- those that use historical data and put it to work

- those that use historical data but don’t put it to work

Don’t get me wrong, historical data is important. It’s used to project sales, calculate trends, etc. You can use it for a number of things. But it can’t be the only thing that you use.

Particularly as technology advances seemingly every 6 months, you have to be forward thinking and analytical.

Historically-Minded vs. Forward-Thinking

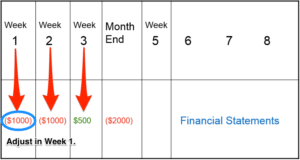

Let’s look at the difference of being historically-minded versus forward-thinking.

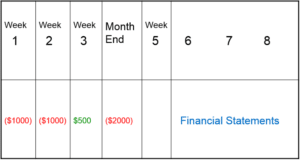

Historically-Minded

However, it isn’t until Week 6 when they receive the financial statements that they realize that the company lost money this month. If only there was a way that they could have known about the losses sooner…

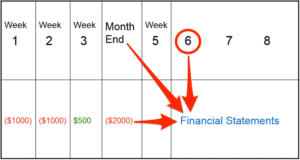

Forward-Thinking

This thought process allows you to adjust projections for sales and inventory, manage your human capital, and address any cash flow issues.

Forward thinking also adds value to your position as a CFO

Technological Advances = Automation

So why should you care? You aren’t responsible for the financial results of the company, just reporting the numbers, right?

Not if you want to stay relevant (and employed). We’ve seen automation take the place of humans in factories for years. But what you might not realize is that automation is quickly coming (and in some cases, is already here) to the accounting world as well. In the not-too-distant future, look for smart accounting systems that can capture financial information and produce financial statements with the push of a button. Not good for you if all you’re doing is cranking out financial reports…

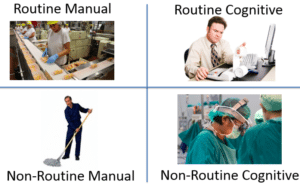

Here’s what we’re seeing about how automation is affecting the workplace.

Non-routine jobs are those that cannot be automated. They either require skills that can’t (at least for now) be accomplished by technology or take a great deal of skill, talent and independent thinking. Again, the work can be either cognitive or manual in nature.

Example 1 – Routine Jobs

A CEO has to make a decision about whether to continue paying a bookkeeper or to onboard a new accounting system to automate financials. The bookkeeper has made several mistakes over the past couple of months that could have severely impacted projections if not caught early. The new accounting system automates every invoice and payment before a single person can touch the invoice. This position is routine because you can easily replace it with an automated system while still ensuring the accuracy and efficiency for a lower cost.

Example 2 – Non-routine Jobs

A chief of staff in a hospital is facing a decision about whether or not to automate neurosurgery. If the chief of staff decides to automate the role of a neurosurgeon, she risks losing customizability and efficiency as a robot cannot see every cell of a cancerous tumor. Sure, a neurosurgeon is human and will make mistakes. But a neurosurgeon has approximately 8 years of school with 4 more years of training and probably have 5-15 years under their belt. In this case, the neurosurgeon’s skill and ability to adapt to conditions on the ground is what makes them valuable and their job difficult to fully automate.

So what should you do if you find yourself in a routine role? You should assist in automating those tasks that you can. Then, shift over to non-routine tasks such as analysis and problem-solving. Adding value in this way will ensure that you stay relevant despite advances in technology.

Pyramid of CFO Value

People often look at the CFO as an accounting and/or compliance figure in the grand scheme of a company. As we start from the bottom of the pyramid (accounting/compliance), we find that this type of job function is most likely going to be automated.

Particularly as continuous accounting becomes more widely used, this financial function will progress into an automated system. Continuous accounting is just the start of new automation processes that pertain to large sources of data. Accounting technology such as continuous accounting establishes a precedent for timely, cost-effective, and/or high-quality improvements for business.

As you move up the pyramid of value, your role becomes more difficult to automate due to the training and experience necessary to successfully carry out these tasks. Since a good CFO improves profits and cash flow by 1-2%, you can essentially make yourself un-automatable (yes, I made that word up).

Where You’re Going

It’s all about where you’re going, not where you’ve been. A Flash Report is an excellent way to look into the future. It assesses KPIs, or key performance indicators, in order to create a periodic snapshot of key financial and operational data. This weekly assessment gives you the capability to not solely rely on historical financial statements to run your business.

As a management tool, it enables you to monitor and review profitability, productivity, and liquidity on a weekly basis.

Start driving with your eyes open. Discover why your KPIs are so important to be forward thinking. Download your KPI Discovery Cheatsheet today to start managing your financials as a forward-thinker.

[box]Strategic CFO Lab Member Extra

Access your Flash Report Execution Plan in SCFO Lab. The step-by-step plan to create a dashboard to measure productivity, profitability, and liquidity of your company.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]