See Also:

CEI vs. DSO

Key Performance Indicators (KPI’s)

How Does a CFO Bring Value to a Company?

5 Stages of Business Grief

Collection Effectiveness Index (CEI)

The Collection Effectiveness Index, also known as CEI, is a calculation of a company’s ability to retrieve their accounts receivable from customers. CEI measures the amount collected during a time period to the amount of receivables in the same time period. In comparison, the collection effectiveness index is slightly more accurate than daily sales outstanding (DSO) because of the time period. A company’s CEI can be calculated for any amount of time, small or large. Conversely, DSO is less accurate with shorter time periods, which is why DSO is calculated every 3 to 6 months.

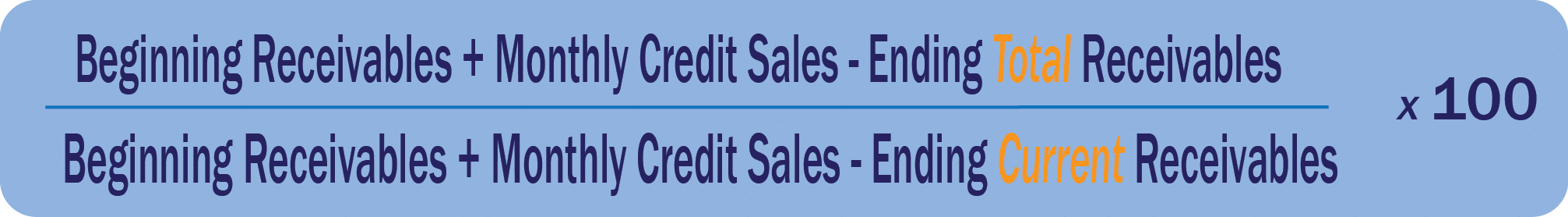

The Collection Effectiveness Index Formula

The formula consists of the sum of beginning receivables and monthly credit sales, less ending total receivables. Then, divide that by the sum of beginning receivables and monthly credit sales, less ending current receivables. The value is then multiplied by 100 to get a percentage, and if a CEI percentage is close to or equals to 100%, then that means that the collection of accounts receivables from customers was most effective.

(Are you look for more ways to improve your cash flow? Click here for the free complete checklist guide to improve your cash flow!)

CEI and Your Business

The collection effectiveness index is one of the most useful tools a company can use to monitor the business financials. It measures the speed of converting accounts receivables to closed accounts, which then indicates new methods or procedures one can use to retrieve accounts receivables even more. If the CEI percentage decreases, then that’s a key performance indicator that the company needs to put in place in policies or investigate the departments in more detail.

How to Increase a Company’s CEI

Among other ways to reduce accounts receivable, the collection effectiveness index alerts when and how to change the process of retrieving those accounts. By monitoring cash in a company more frequently, financial leaders will notice a pattern and are more inclined to make a change quicker. Changing your policy from checking 3 times a year to 6 or 8 times a year, and the results that come from it, will show a substantial difference in a company.

Access your Flash Report Execution Plan in SCFO Lab.

Click here to learn more about SCFO Labs[/box]