The Institute of Fiscal Studies authored a study on tax systems in the UK called “Tax by Design: Mirrlees Review.” They concluded that “in the long-run, the tax system should be judged in part on its impact on the sustainable growth rate of the economy… viewing efficiency in a dynamic as well as static sense.” As we enter into tax season, you as the financial leader of your company should understand the impact of FIT on sustainable growth rate in your company.

What is Sustainable Growth Rate?

Sustainable Growth Rate (SGR) is the maximum amount of growth that an organization can sustain without increasing their financial leverage. It commonly suggests the percentage (%) growth in revenue that an organization can sustain with its current profit margin, earnings retention rate, leverage, and asset turnover.

[box]

Sustainable Growth Rate (SGR) = (1-d) x ROE

Dividend Payout Ratio (d) = dividends / earnings

Return on Equity (ROE) = net income / shareholders’ equity

[/box]

Even though there are numerous methods to increase your sustainable growth rate (such as increase the profit margin, asset turnover ratio, assets to equity ratio, or retention rate), the federal income tax can blindside you if you don’t prepare for it. FIT is unavoidable.

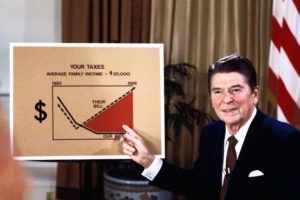

There are several economic theories concerning FIT, including the Laffer Curve and Reaganomics, that can be utilized to understand the impact of FIT on your SGR.

Laffer Curve![impact on sustainable growth rate]()

The Laffer Curve, created by Arthur Laffer, demonstrates the relationship between governmental tax revenue and tax rates. It important to understand this curve because at any given point on the curve, the amount of financial leverage you can supply to spur growth will differ.

If the tax rate is at Point A, then the government isn’t necessarily pleased by leaving your company with more dropping to the bottom line. This level of tax rates allows for your company to be more productive. Not only will you be able to breathe easier knowing you don’t owe the government so much, but your employees will be incentivized to work harder. They now know that their hard-earned money will land in their pockets. But having low tax rates isn’t always ideal. This is because your employees don’t have to necessarily work more to attain the “same” amount of “success” as they would at the Equilibrium Point.

If the federal income tax rate is at Point B, then both your company and your employees will question why should work be done. Since the government will be taking away 80-95% of revenue or income, the motivation to work will decrease significantly. At the point, your sustainable growth rate will be affected dramatically because the amount of financial leverage you have to spur growth is minimal. This point is typically seen in dictatorial economies.

Like in all things, there is an Equilibrium Point. This point allows for the government to make money as well as your company. Productivity remains high, allowing you more flexibility to provide growth in the company.

Although you cannot control the tax rate that the government has set, know how it impacts your company. One way to do this is by understanding the history of income tax rates.

Reaganomics

President Ronald Reagan called for widespread tax cuts during his presidential election in 1980. Within this economic plan, we saw four major factors:

- deregulation of domestic markets

- increased military spending

- widespread tax cuts

- decreased personal spending

The hope in implementing this plan was to reduce company’s expenses (primarily from tax expenses) to improve the economy as a whole. But as we saw with the Laffer Curve, there is a point when federal income taxes could be too low to improve the sustainable growth rate of a company.

Impact of FIT on Sustainable Growth Rate

In any company, cash is king. One of the major cash expenses that every company has is federal income taxes. Any tax strategy used to drive financial performance should not be considered as the end-all-be-all. The FIT reduces the amount of cash or financial leverage you have to increase your sustainable growth rate.

However, there are mechanisms or key performance indicators (KPIs) that you can utilize to focus on increasing your internal financial leverage. FIT is something that you cannot avoid. It will affect your sustainable growth rate. But by using a few indicators to measure profitability, etc, you’ll be better able to increase your SGR.

[box](NOTE: Want to start measuring your company’s KPIs today? Check out our KPI Discovery Cheatsheet!)[/box]

When calculating your sustainable growth rate, it’s important to recognize that any positive rate can allow for growth. It’s imperative to calculate FIT when you’re expecting or desiring growth.

Sustainable Growth Rate (SGR) = (1-d) x ROE

ROE (net income / shareholders’ equity) should have your FIT factored in. It’s easy to forget this important step until you find your wanting to utilize your internal financial leverage and you lost 35% of profit, severely reducing the financial leverage that you thought you had. Know the impact that the federal income tax has on your sustainable growth rate.

If you want to track your sustainable growth rate, then download your KPI Discovery Cheatsheet today.

[box]Strategic CFO Lab Member Extra

Access your Strategic Pricing Model Execution Plan in SCFO Lab. The step-by-step plan to set your prices to maximize profits.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]