How do you focus on improving profitability instead of just boosting sales? 2016 wasn’t the best year for some of us, but the new year provides a perfect opportunity to reassess goals. An entrepreneur’s natural tendency is to increase sales in order to balance out last year’s financials. But what many entrepreneurs fail to consider is are those sales actually profitable?

There’s Only So Much Cash

Why is improving profitability instead of simply increasing sales so important? Because, believe it or not, you can actually grow yourself into bankruptcy.

Huh?

Many are quick to say that more sales is the solution – however, there are a lot of factors you have to consider before you start selling everything. One of the most important metrics you must know is your cash conversion cycle. The cash conversion cycle is the length of time it takes a company to convert resource inputs into cash flows.

Cash Conversion Cycle Formula:

Cash Conversion Cycle (CCC) =Days Sales Outstanding (DSO) + Days Inventory Outstanding (DIO) – Days Payable Outstanding (DPO)

– or –

CCC = DSO + DIO – DPO

Days Inventory Outstanding (DIO): This is an indicator of how quickly you can turn your inventory into cash. Reducing DIO is good. If all of your cash is tied up in inventory that isn’t moving, then you might have a problem.

Days Payable Outstanding (DPO): This measures how quickly you are paying your vendors. If you are consistently paying your vendors more quickly than you are getting paid by your customers, then you risk running out of cash. If your vendors aren’t giving you a discount for paying early, then why are you paying early? If you have 30 days to pay, then why pay on the second day? Use that cash for the other 28 days you have for other vendors who offer you discounts or to fuel growth.

Managing the cash conversion cycle is a key way you can enable your company to grow. And we all know how fond entrepreneurs are of growth…

(Click here to learn How to be a Wingman and be the trusted advisor to your team.)

Cash is like Jet Fuel

Often, entrepreneurs (especially those from a sales background) focus on improving sales. What many fail to realize is you can actually sell yourself into bankruptcy.

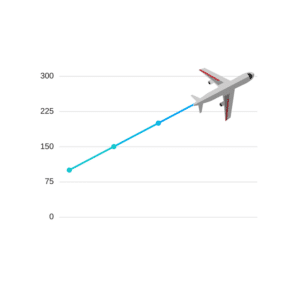

Let’s compare a business to a jet. If a jet is moving at a constant pace, then the fuel used to power the jet runs out at a constant pace. From a business perspective, if the sales in a company are constant, then the cash and assets required to fuel the company is also constant and predictable.

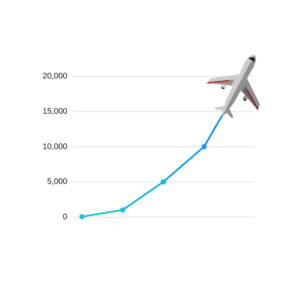

But if an entrepreneur decides to increase sales to a greater degree than cash flow, almost vertically, then the business may run out of fuel (cash) and can ultimately crash and burn.

The quicker you grow, the quicker you burn cash.

Sustainability is Key

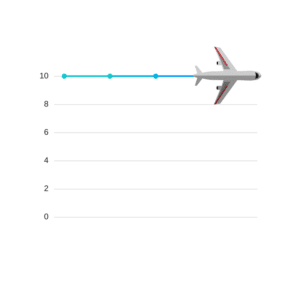

The sustainable growth rate of a company is a measure of how much a company can grow based upon its current return on assets. The sustainable growth rate of a company is like the wind turbine of a jet. Naturally, the wind turbine gives the jet a 5-10% incline. But what if you want to grow to 25%? Or 50%?

To grow faster than your return on assets, you’ll need to take on additional debt or seek equity financing. Either you pay for it, or someone else does. To avoid increasing debt or giving up control, it’s important to maximize your current asset velocity (think managing CCC) and make sure your sales are profitable.

[highlight](Be more than overhead. Be the wingman to your CEO by increasing cash flow!)[/highlight]

How to Grow Your Business

If you want to grow your business, there are a couple of things you can do:

(1) Increase your profitable sales. This means deciding which projects have the lowest risk, but highest reward for your business. Time is money, so which customers are worth your time? In exploring this, you might have to conduct some market research for your target market.

For example, if you have some customers who are slow to pay, they’re straining your liquidity. Although it may be difficult, you might have to fire some customers and focus your resources on customers that aren’t such a drain.

(2) Increase capital. Capital is the funding you need to grow the business. Capital can be an investment from an outsider, or it can be cash generated internally by increasing cash flows and maximizing profitability.

Internally: A company can increase cash flow by managing the cash conversion cycle. Collect your receivables faster and manage inventory levels and payables. It is a good idea for a company to grow as organically as possible, meaning growing cash internally.

Externally: If you’ve tightened up your CCC as much as possible, it might be necessary to look for outside sources of cash. However, having external sources of cash is a trade-off; you’ll have debt with a bank, and you might have to give up part of your company to investors (depending on the terms).

Conclusion

So when your business owner says, “let’s increase sales!”, remember focus on making profitable sales. Look at improving the Cash Conversion Cycle to make the most of your internal resources. Consider outside financing when/if your existing return on assets won’t get you where you want to be.

Don’t crash and burn – make sure your company has the fuel it needs. Your business owner is looking to you to help them grow their business. To learn how to do it, access the free How to be a Wingman whitepaper here.

[box]Strategic CFO Lab Member Extra

Access your Strategic Pricing Model Execution Plan in SCFO Lab. The step-by-step plan to set your prices to maximize profits.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]