This isn’t a new story. In fact, if you’re in finance, either you or the person in the office next to you has experienced this. In this blog we’ll give you some general guidelines on what to watch out for in the bank lending cycle.

What is the Lending Cycle?

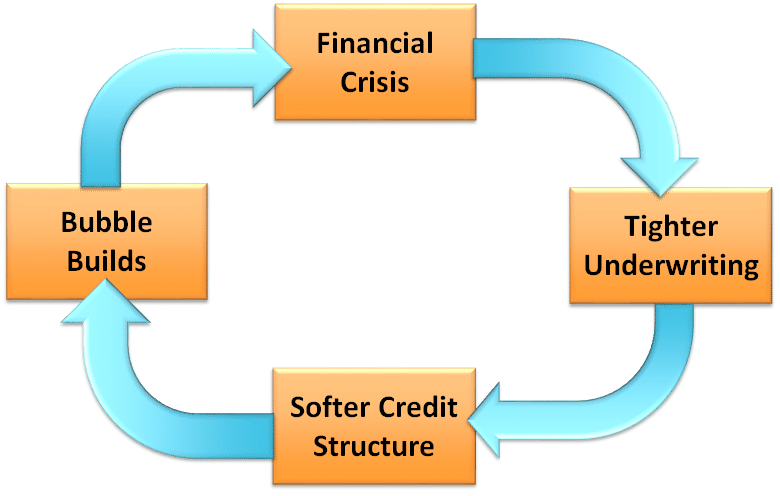

After a financial crisis, banks tend to tighten up their loan underwriting making capital more difficult to obtain. During this time, businesses seeking additional sources of funding will likely face an uphill battle convincing their lender that they are a risk worth taking.

As the economy improves and the lending environment becomes less risky, credit structures begin to soften and financing becomes easier to obtain. These easy-to-borrow periods are marked by lower interest rates, lower requirements and conditi

Not surprisingly, with all the new capital in the marketplace, an economic bubble builds. Eventually, the bubble bursts causing another financial crisis and the cycle begins anew.

When determining whether or not a banker wants to lend to you, they usually evaluate how risky the investment is. Obviously, banks do not lend to anyone and everyone. Rather, they calculate how much of their lending is trustworthy. What is this company’s credit history? What other debt do they have? How are their financials? These are just a few things that a lender evaluates before making the final decision.

Why is the bank playing hard-to-get?

As a business person, you’re probably familiar with how “flirty” a bank can get with you. When you actually need the loan, they don’t want to give it to you. Then they tease you with a good rate and terms when you don’t need the loan. This isn’t just because you walked in wearing the wrong clothes, or even because of your numbers. Sometimes, because of the bank lending cycle, it’s just more difficult to get a loan at that time.

[highlight]Want to know how to increase the impact you have in your company? Access the three best financial tools we’ve ever created to learn how![/highlight]

Loans and the Economy

In one of our Wolff Center for Entrepreneurship classes, I asked the question: “Is it a good idea to start a business in a recession? Raise your hand if you think it is.” Only a few people raised their hands. In a way, it is a good idea, and this is why:

Like any product in the economy, prices and rates fluctuate due to supply and demand. When the demand is lower for a loan, banks are more inclined to charge a lower interest rate. When demand is high, banks implement a higher interest rate. During a recession, businesses are more debt-averse, driving down interest rates. When rates are low, there’s pretty much a “discount” to take out a loan. And every entrepreneur loves a discount.

Similar to demand, supply also affects the interest rates for a bank loan. When banks are flush with cash from customer deposits, they need to put those assets into service in the form of loans. With lots to lend, banks tend to offer more attractive credit terms and interest rates. When the economy is suffering and banks don’t have as much on deposit, the supply of capital is diminished and, consequently, is more expensive.

The Environment affects the Economy

This is why it is crucial to understand the environment and industry your company is associated with. It amazes me how many people conduct business without reading or looking into their industry’s current events. Those current events affect what sale you’re going to make, how cheap your supplier will sell you a part, and… whether or not it will be possible to get a loan.

Imagine walking into work a day after the housing market crisis in 2007 and saying, “I’m going to invest in a condo.” Assuming you’ll still have a job at that point, anyway. If you take away anything from this article, understand this: Stay updated in your industry, because those events directly affect the economy.

Loan Officers are Actually Salespeople

Loan officers are really salespeople selling loans. They have quotas like salespeople. When there is low demand or availability of capital, loan officers are often less aggressive or even laid off. This is similar to a salesperson who is laid off due to a decrease in revenues. When capital is flooding the market, banks will often hire hoardes of new loan officers to put their money to work. This explains why your banker rarely calls on you when you really need them but pursues you doggedly when times are good.

Conclusion

In conclusion, the economy affects the bank lending cycle. It may seem like common knowledge to stay aware of your industry, but you would be surprised how many clients I meet that have no idea what is really happening in the world. If you understand the economy, then you’ll understand the patterns of what a bank needs. A bank is like a business, so if you start thinking like a bank (which you most likely already do), then you’ll be speaking their language in no time. Catch next week’s blog about how to appeal to your banker, and how to get a loan even when banks aren’t budging.

[highlight]What do you do when your banks aren’t budging? Now’s the time to really think like a CFO. Download our three best tools in the company to start speaking the CFO language.[/highlight]

[box]Strategic CFO Lab Member Extra

Access your Strategic Pricing Model Execution Plan in SCFO Lab. The step-by-step plan to set your prices to maximize profits.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]