The Accounting Gap:

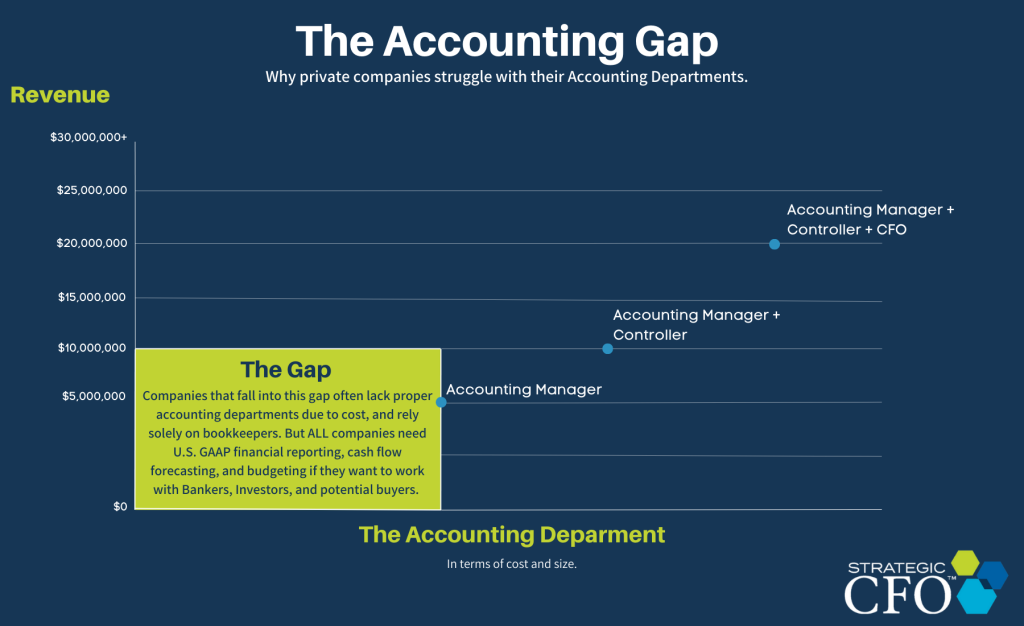

It’s unfortunate, but true. A large gap exists between the accounting departments of large or publicly traded companies and smaller or private companies. In our past 25 years of consulting we’ve noticed that more often than not, these smaller/private companies will fill the gap with Bookkeepers, rather than the degreed Accountants/CPAs they require. They simply can’t afford or are not willing to spend the money on a professional accounting department.

Companies operating under $10 or even $20 million in revenue struggle to afford a professional accounting department, and often fall into the gap.

Companies operating above $5 million in revenue should have at least one Accounting Manager. Companies operating above $10 million should have at least one Accounting Manager, and a Controller. Companies operating above $20 million in revenue should have at least one Accounting Manager, Controller, and a CFO.

Cost of Labor in the U.S.

At Strategic CFO, we define an Accounting Manager as someone with a four-year Accounting degree from a reputable university with at least 5 years of relevant work experience. The base salary for this type of professional in the United States is about $85,000 in 2023.

At Strategic CFO, we define a Controller as someone with a four-year Accounting degree, has their CPA/Chartered Equivalent with at least 10 years of relevant work experience. The base salary for this type of professional in the United States is about $135,000 if not more in 2023.

Lets do some math:

Accounting Manager $85,000 base salary

Controller $135,000 base salary

Total $220,000 x 5% bonus = $231,000 x 35% taxes and other benefits = $311,000.

This is on the low end, and for only two professionals. The labor shortage of Accounting professionals will only make these salaries increase.

The Difference Between Bookkeeping and Accounting:

Bookkeeping is simply recording transactions into a system, and generating the system’s built-in reports. A Bookkeeper can pay bills and generate invoices, but they do not apply U.S. GAAP Principals to their work. They cannot generate a U.S. GAAP balance sheet, P&L Statement, cash flow forecasts, or budgets, and they usually do not have an accounting degree.

Accounting is applying generally accepted accounting principles (U.S. GAAP) to every transaction so that your income statement and balance sheet provide correct revenue recognition, accruals, costs, margins, and a true measurable bottom line. These principles allow you to measure key performance indicators (KPIs) in your business and enhance decision-making. A company looking to work with Bankers, Investors, or potential buyers will need all of these things.

Our Experience:

We have met many privately held companies owned by a single entrepreneur, a family, or partners that we have NOT been able to convince that the cost of accounting professionals is “worth it”. Here’s why:

The Economics (an example):

Annual Sales $15,000,000

Cost of Goods Sold ($11,250,000)

SGA ($1,500,000)

Operating Profit $2,250,000

The example business above has an operating profit of $2.25 million, this is a 15% operating profit. Not too shabby for your family-owned business. Now we show up and try to convince them to spend $300k or more on a professional staff of qualified accountants. That is $300k that currently goes to the lifestyle of the owner or family running this business. That is a hard sell. Now their operating profit dips down to below $2 million per year.

It’s understandable why they wouldn’t want to spend that money, and anyone in their shoes would likely do the same. The problem is that the owners/entrepreneurs don’t understand the difference between Accounting and Bookkeeping, or the importance of maintaining accurate records that are U.S. GAAP Compliant.

So what are the downsides of NOT keeping your books and records per U.S. GAAP?

- Your margins are wrong in the income statement

- You do not have the key performance indicators, margins, and other data to run your business

- You have run it “from the gut” up until now, but sometimes you lose sleep at night

- Your balance sheet is likely wrong and so is your working capital

- You will have a lower enterprise value

- It is harder to go to the bank to get financing

- Your tax return might be wrong

- Without the balance sheet and margins correct, you may be experiencing fraud and not even know it

- Cash is king, even if you have a lot of cash in the bank, you may be bleeding cash somewhere and do not even know it

- If you are high growth, you may not have sustainable growth and run out of working capital

- So you are making $2,250,000 operating profit as in the example above, but you could be making $2,750,000 with the proper professional accounting team

- A good accounting team made up of professionals will usually pay for themselves and as we coach all of our people, they are not just a cost, they will add to the bottom line

How to fill the Accounting GAP:

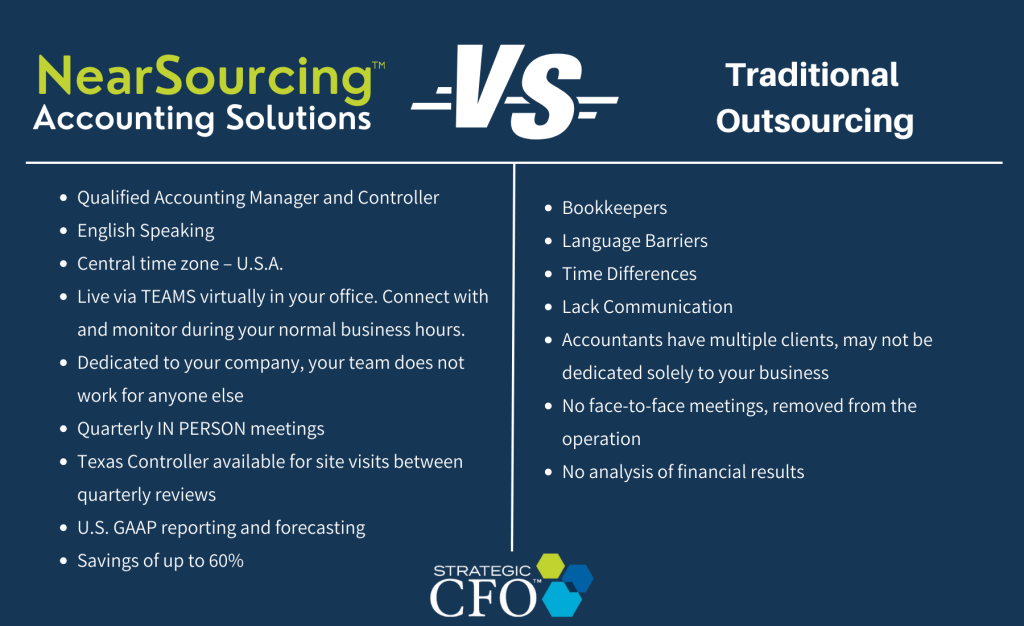

We have all heard of outsourcing, it seems that in this era, IT, HR accounting, everything is outsourced. But we have never liked or believed in outsourcing your accounting for the following reasons:

- The outsourced service is usually located in some other country in Asia where the time difference is at least 12 hours. Although they tell you “we work on your schedule”, that just does not work.

- Language barriers

- Too far removed from the operation. We are a big believer that the accounting team and the operating team need to be very close. They need to have constant communication and discuss transactions all the time.

- The typical “outsourced” company is working on several clients at a time, they are not dedicated to your business.

- You never meet the accountants providing you service, we are in a world of Zoom and Teams which is good. But we need face time with each other. Especially in accounting and operations.

- Accounting work may not be U.S GAAP Compliant, and many outsourced accounting firms are also simply Bookkeepers.

The Solution – Fill the GAP:

Rather than outsource your accounting to the other side of the world, you can NearSource it to our firm.

NearSourcing Accounting Solutions is a blend of traditional outsourcing and an in-house accounting department. Your NearSourcing team will complete the daily tasks remotely. (U.S. Central time zone).

Included in your NearSourcing team is your Texas based Controller who oversees your remote team. The entire remote NearSourcing Team and Texas Controller will travel to meet you onsite for quarterly reviews of financial results, analysis and forecasts in person.

Learn more about NearSourcing Accounting Solutions, explore pricing and schedule a FREE consultation.