What do the Academy Awards and Old Westerns have to do with traditional CFO practices? There are norms that are acceptable now that were never allowed before. When the audience changed, the Academy adapted to the audience. So when the new generation steps into your office, you have to re-evaluate what it really takes for them to advance their career. Some might have capabilities of a CFO, even though they haven’t traditionally trained for it.

In the past, there was a certain path that you take to become a CFO. Some think the key is being a CPA to be a CFO. But now that times are changing, is it really necessary?

We like to talk about technology, millennials, current events, and politics, but they pretty much all say the same thing: if we constantly live in the past, we won’t have much of a future.

Timeline for a CFO

My friend’s nephew is graduating in accounting, and he’s wondering… “Do I need to get a CPA or MBA?” In other words, do you need financial expertise to be a financial leader?

Now don’t get me wrong… some people are really successful in this path. In fact, I definitely agree that CFOs, or any financial leader in general, should have a broad range of skills other than financial skills. Here is a pretty common path to CFO success:

Earn a CPA to be a CFO (and/or MBA).

Some might say you won’t have a successful financial career without a CPA license. The primary purpose of a CPA is for financial authorization, such as auditing and reviewing financial statements. Careers in finance such as accounting and auditing mostly require a CPA. Benefits of a CPA include larger salary potential, more career opportunities in larger companies, job security, and trust within larger companies. Larger and older companies with more revenues require more tenured and experienced employees.

MBAs are more broad. Studies show that those with MBAs have higher employment rates (around 60-70%) and higher base salaries. With MBAs, you can specialize in skills in addition to finance, such as supply chain, marketing, management, etc. So if you’re looking to gain new skills other than finance, MBA might be a better choice.

Gain Financial Experience Within the Company

Typically within the first few years, new hires will learn the basics such as budgets and accounting. As time and experience grows, new opportunities are formed, such as capital investments and larger accounts. Financial employees will gain expertise in skill sets before moving on to the next step.

[highlight]Everyone has their own habits… how do you know which is the best for your company? Download our free guide, How to be a Wingman, to be the best wingman to your CEO.[/highlight]

Take on Bigger Roles Outside of Your Comfort Zone

This is where getting an MBA and taking initiative comes in. CFOs are more than financial experts – they are leaders. By this point, basic accounting practices should be like reciting the alphabet… it’s that easy.

Financial leaders should always want to learn more skills. Taking on bigger roles outside of their comfort zones reflects that mindset and makes them stand out against their competitors.

Hold Controller Positions

This is pretty self-explanatory. The controller positions create more responsibility for the financial leader. After all, how can they handle a C-level position if they can’t handle a standard leadership position first?

This seems like a pretty solid path, doesn’t it?

Looking at companies now, however, aren’t as “solid”… and here’s why:

Modern-Day CFOs

When you think of a CFO after 2012, what do you imagine? Long gone are the days of bluetooth-talking, pinstriped suit-wearing CFOs, white-haired males. When I picture a modern-day CFO, I picture someone in a plaid long sleeve, young, and focused on multiple aspects of the company. That seems like an exaggeration, because it is! Overall, it is also a representation of how different the CFOs of today are, compared to Generation X and Baby Boomers.

The Past 5 Years

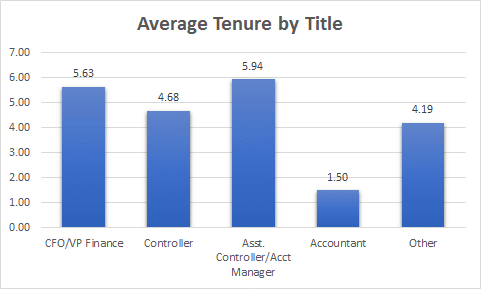

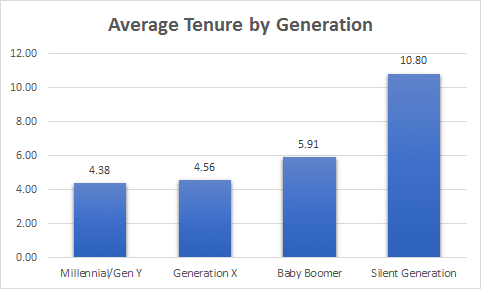

In our survey held in 2015, the average tenure for a CFO is 3-5 years. This contradicts the timeline above… Why would a CFO want to work 3-5 years after 15+ years of building his or her career?

As generations evolve, the tenure decreases. For example, the average tenure for millennials, according to our survey, is around 4 years.

2015 Survey Results: https://strategiccfo.com/results-average-tenure-of-a-cfo-survey

Over the past 5 years, the CFO role has proven to be more complex and centered on leadership ability. CFOs now are more adaptable to change, hence the short tenure of a CFO.

The Next 5 Years

Ever heard of the “gig economy”? It’s the growing trend that contract workers and short-term “gigs” are commonly practiced. A great example of this influence is a friend of mine, who has 35-40 years of financial leadership experience. He recently quit his job, and is now looking for contract work. This puzzled me at first. He is a great person, and a very knowledgable asset to any company. As you can see, the gig economy is not only for the millennial generation. It’s a growing trend, for all leadership types.

Is this a reference for the trends to come? In the next 5 years, we can expect more contract work and less “climbing the ladder”… like getting your CPA to be a CFO.

Conclusion: Learning to Adapt

One of the ways we can grow as companies and financial leaders is to learn to adapt. If the world is shifting closer to a gig economy, explore that theory. If the average tenure for a CFO is less than 3 years, maybe we should change our hiring and training practices. Anything is adaptable if you’re constantly taking initiative and thinking one step ahead.

[highlight]Don’t forget… the CFO is the CEO’s wingman. Learn how you can be the best wingman with our free guide![/highlight]

[box]Strategic CFO Lab Member Extra

Access your Projections Execution Plan in SCFO Lab. The step-by-step plan to get ahead of your cash flow.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]