There’s never a good time to make a mistake. However, errors during times of distress can be especially crippling. As we enter month 17 of the oil crisis, even minor missteps can have devastating consequences. To help you stay vigilant, we’ve detailed some common mistakes in troubled times that organizations make and how to avoid them.

Mistakes in Troubled Times

Changing Too Slowly![mistakes in troubled times]()

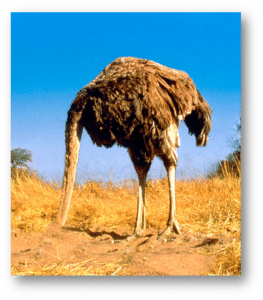

Regardless of what kind of trouble they’re experiencing, companies tend to linger in their old ways for longer than they should. Failure to react quickly and an “everything’s fine” mentality will cause more damage the longer it’s sustained.

In month 17, have you already started to adjust to the economy? Instead of sticking your head in the sand, process information and take actionable steps to maintain a) a positive cash flow and b) the longevity of your organization.

Unrealistic Expectations

I’ve said it countless times to my coaching participants over the past year “the marketplace thought this oil crisis would last for 3-6 months, but economists project it to last 18-36 months.”

In this extended period of financial stress, it’s imperative to maintain a positive cash flow. Find holes in your business where you are bleeding. Here are some examples of what actionable steps some companies have taken to maintain positive cash flow:

- ask employees to work 4 days instead of 5 days

- give employees a pay cut with the promise that their position will be maintained

- streamline your company by removing any job positions that do not return a profit for the company

This length of economic downturn is an opportunity for your company to regroup and create an action plan that could be a catapult for success after recovery.

[box](NOTE: Do you know the direct costs to a single unit? By downloading the free Know Your Economics tool, you will be able to shape your economics to return a profit. Click here to learn more.)[/box]

Overreacting

If you projected in June of 2014 that the economic downturn would last 6 months and are now sitting in month 17 with little to no cash, you’re not alone.

Because they waited too long, panic sets in causing many companies to overreact. Massive lay-offs, budget cuts, and cheaper quality materials are typically the cuts made at a moment’s notice. Before you know it, you’ve cut all your upper management leaving one junior account manager with the responsibility of 15 senior managers.

Reacting quickly and carelessly can have major repercussions. Instead, first gather adequate information. Before considering making a decision, think about how that decision is going to affect your organization in the long term.

Does your organization value experience or does what you do not require an experienced work force? Those few thousand dollars saved by hiring cheaper, less-experienced people could make a major difference in your company’s survival. But if your organization’s success is based upon relationships, it might be best to consider keeping the more expensive person. People (both employees and customers) tend to follow people that they like.

Does your organization stand on producing quality product? If the materials for your product are expensive, then there may be a less expensive vendor with the same quality. But if your organization stands on its quality, do not react quickly by cutting the quality of your product. Stand on what your organization was built on and continue that legacy by looking at it from multiple angles. If you take a Rubik’s Cube and try to solve it by only looking at one side, you aren’t going to be able to solve the cube (I’m assuming you’re not a Rubik’s genius here).

Lack of Transparency

Often, senior management becomes tight-lipped when things get tough out of embarrassment or a desire to protect the team from bad news. In times of distress, transparency with your team is more important than ever. People are much more likely to work with you when they have the whole picture and understand how they fit into the solution.

If your organization has already downsized employees and cut costs, it’s time to bring the team together to brainstorm. Some of your front-line employees might see things differently than the executives. Take some time and listen to them. Here are some tips to consider when bringing the team together.

- Spread out the facts for every employee to see

- Do not undercut your paying customers

- Translate every action into a dollar value

Transparency will go a long way. If management proves to the front-line employees that they are fighting for the company (and thus the front-line employees), loyalty will be dramatically higher.

There are many options to ride out an economic downturn with your employees: limiting unnecessary resources, reducing pay and work hours, and scrutinizing every process before a decision is made. Do what’s best for your company, but know that you work with real humans.

It’s tempting to nickel-and-dime customers when times are tough for your company (I’m looking at you, airline industry). But, your paying customer should not suffer due to your company’s distress. If cash is tight, focus on providing excellent customer service to your loyal customers. This is your most valuable resource! Improve your service, go out of your way to serve your customer without nickel-and-diming them. Just like you’re trying to create loyalty with your employees, create loyalty with your customers.

Failure to Understand Your Company’s Economics

One of the most common mistakes I see companies make is taking action without investigating the impact on the firm’s economics. How will reducing your sales price in an effort to increase volume impact your bottom line? Have you decreased overhead costs correspondingly? If you reduce the cost of your materials and product quality suffers, how much do you need to sell to still cover fixed costs?

Knowing your economics is crucial to preventing mistakes from happening in troubled times. Translate every actionable item into a dollar item. This will help streamline what items can be tweaked, thus increasing your chances for success.

[box](NOTE: Want to double-check that you know your company’s economics? Download the Know Your Economics tool here.)[/box]

[box]Strategic CFO Lab Member Extra

Access your Flash Report Execution Plan in SCFO Lab.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]

Whatever decisions you make, be honest with your management, employees, and customers. It’ll benefit you in the long run.