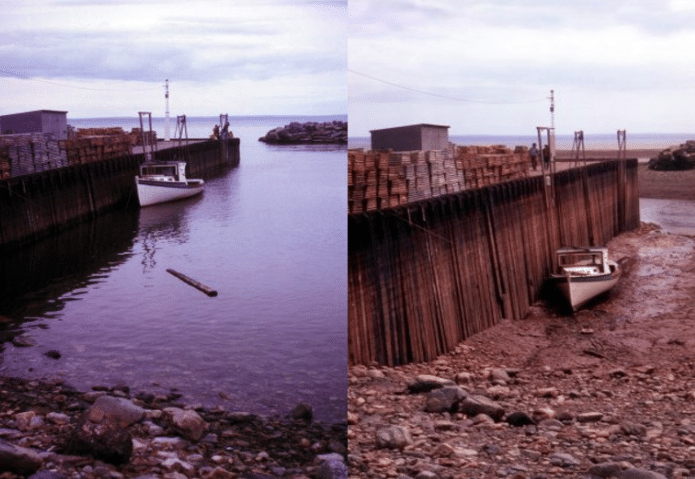

Has anyone ever warned you, “don’t get caught swimming naked”? It may sound strange, but it’s a reference to Warren Buffet’s famous quote “Only when the tide goes out do you discover who’s been swimming naked”. As a financial leader, it is your responsibility to know when the tide is going out so that you can prepare not to be caught swimming naked. Here’s your warning..

The tide is getting ready to go out and may reveal some troubling things in your business as a result of the Fed (the Federal Reserve System – the United States’ central banking system) adjusting its interest rates. This has huge consequences for not only businesses in America but also companies that do business with America.

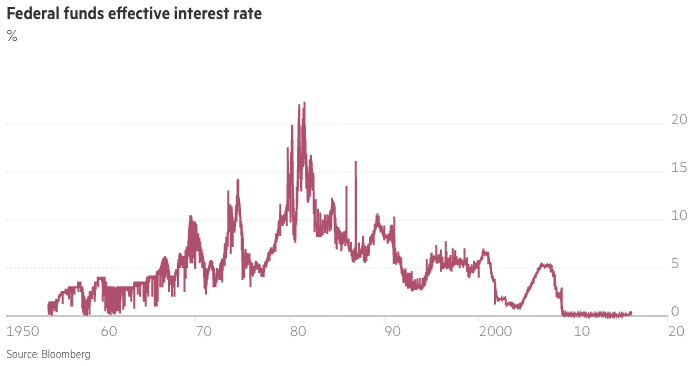

Background on US Interest Rates

The Fed lowered the short term interest rates from 0.25pt from 3-4pt in the wake of the housing market crash. They issued money through bonds to the marketplace for mortgages. Consequentially, this dropped the long-term interest rate.

The Fed: Interest Rates are Going Up

The Federal Reserve has given notice as of March 15, 2017, that the interest rates will be increasing over the next few years (estimated 5 years). There’s already been some movement over the past couple of months. Janet L. Yellen, the Fed’s Chairman, plans to slowly adjust the interest rates so that it will have the time to react to President Trump’s infrastructure spending and tax cuts.

The goal of the Fed is to raise the short-term rate without exceeding the long term rate. This act of leveling the interest rates is to essentially balance their financial statements and get it back to a normal level.

The Financial Times released an analysis on what is happening and how it’s going to impact us. One of the things noted is that the interest rates will increase slowly and cautiously. This may seem like a great idea, and it is, especially when considering any fiscal policy that President Trump rolls out in the next 3.5 years.

But what exactly does the incremental increase of interest rates mean for your company?

What does that mean for your company?

This slow increase of interest rates could be catastrophic for companies that neglect to prepare now. The tide is going out – meaning in a couple of years, there won’t be any cushion to break your fall.

One of the biggest responsibilities I have as the leader of The Strategic CFO is to network with business leaders around the city of Houston. When I discover events or adjustments that will impact the financial leader’s role, I start asking questions. As of late, my question has been… How is the increase of interest rates going to impact your company?

That’s a loaded question. What I’m finding out is even more interesting: nobody is really paying attention to what’s going on. They have their nose so close to their business that they aren’t really looking at the bigger issue in the room. Don’t get caught swimming naked!

Private Equity Firms

Over the past few years, the oil and gas industry has been hurting (especially in Houston). Thankfully, this crisis hasn’t been nearly as bad as the oil and gas crisis in the 1980s overall. However, the reason why companies that would have gone under 40 years ago have survived is because of the substantial amount of private equity money being pumped into these companies. With low interest rates, there’s naturally more money in the economy that can be invested into companies in troubled times.

Barrel of Water

Picture the economy as a barrel of water where money is the water. Right now, the barrel is full of water sloshing around. This is a really unique position. However, the Fed is going to start draining the water incrementally. People aren’t really focused on it because all they see is that there is still water in the barrel.

BUT what happens when people look up in 5 years to find that the interest rates have increased from 2% to more normal levels of 7-8%? Right now, the economy is in a period where if you can fog a mirror, you can get money. But not for long…

How does that change the role of a financial leader?

Over the past 15 years, corporations of all sizes have taken advantage of these low interest rates and have potentially even changed their business model entirely. I have to warn you… Money is getting tighter.

Money is Getting Tighter

For those later in their careers, this is just another cycle. But as a professor for the Wolff Center for Entrepreneurship, money getting tighter has a real impact on my students who are just starting their careers. With money increasing its value and decreasing its quantity, the time to start preparing is NOW.

How to Prepare for Increased Interest Rates

First, identify if you rely on low interest rates as well as the areas of your business that rely on low interest rates.

Once you identify those areas in your business, it time to start assessing and anticipating the worst-case scenario for your company. Download our External Analysis whitepaper to start charting the external factors that impact your company. When you’ve made a list of those potential outcomes with your current business model, it’s time to start prioritizing what needs to be adjusted.

I can’t say for certain how high the interest rates are going to go or how it’s going to impact your company, but I do know that the tide is going out. Soon, we’ll find out who is too over-leveraged, had business models predicated on low interest rates. Have you started preparing for this?

Should you pay down debt?

YES. The reason why is that when interest rates increase, payments increase. Pay your debt down as quickly as possible before you feel the pinch.

Should you raise your prices?

It depends… A better question might be: can you raise your prices? If you are in a competitive industry where there is no option to raise prices, then that’s not possible. You’ll have to find cash elsewhere to respond to increased interest rates.

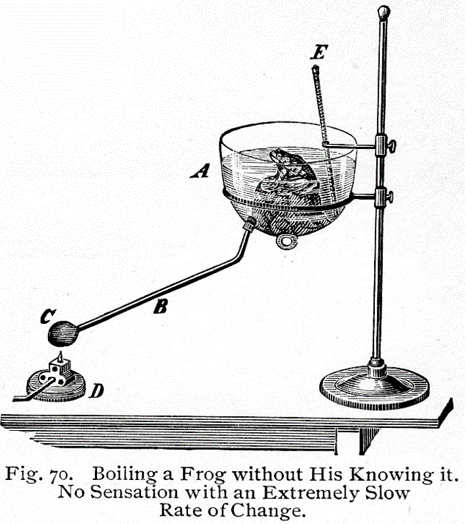

![]() Frog in a Boiling Pot

Frog in a Boiling Pot

Ever try to cook a frog? If you throw it in a pot of boiling water, it will just jump out. But if you put it in the pot and slowly increase the temperature of the water, the frog won’t notice the temperature change until it’s too late. We’ve become accustomed to cheap money, but we can’t afford not to react to the slow increase in temperature that the Fed is planning with interest rates. The result could be disastrous.

Conclusion – Don’t Get Caught Swimming Naked

There’s change in the wind. If you haven’t reacted yet, this is your warning. The tide is going out and you don’t want to get caught swimming naked. Download the External Analysis whitepaper to gain an advantage over competitors starting your preparation to respond to the increase of interest rates.

[box]Strategic CFO Lab Member Extra

Access your SWOT Analysis Execution Plan in SCFO Lab. The step-by-step plan to prepare for any internal or external forces.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]

Frog in a Boiling Pot

Frog in a Boiling Pot