Traditions turned financial fluctuations are to be expected in the American economy. Commercialism takes over this time of year with the holiday rush. With an overload of red sales tags on toys, electronics, clothes, and more, consumers are quickly adjusting to this being a norm. Now with Thanksgiving is right around the corner, we are taking a look at how it has changed drastically from a traditional national holiday to a massive sale.

Financial fluctuations can severely damage your profits. Learn how to price for profit as we go into the most popular sales season! Download the Pricing for Profit Inspection Guide here.

Traditions Turned Financial Fluctuations

Financial fluctuations generally shape patterns throughout industry seasons, with one of the largest humps being in the last quarter of the year (especially for retailers). As a financial leader, it is your responsibility to allocate resources to cope with the massive influx of sales, manage profitability, and mitigate any potential liabilities with hosting a sale.

![Traditions turned financial fluctuations]() History of Thanksgiving

History of Thanksgiving

Thanksgiving originated in 1621 when the Wampanoag Indian tribe and the colonists shared a meal together after the first successful corn harvest. In 1863, President Abraham Lincoln declared it a national holiday. The tradition is to express one’s thankfulness while sharing a hearty meal of turkey, stuffing, veggies, and a variety of pies.

While the holiday still remains a tradition to this day, the past few years have seen Thanksgiving invaded by the financial juggernaut of Black Friday.

Black Friday

Black Friday is one of the most sought after sales days (for consumers at least) in the United States. Traditionally, Black Friday takes place the day after Thanksgiving in the wee hours of the morning. People camp out to get the best deals on clothes, appliances, technology, etc. Over the past few years, however, retailers have begun opening their doors to Black Friday shoppers earlier and earlier. This year, many stores will be open on Thanksgiving day for holiday shopping.

As it’s evolved into an expectation for businesses to have great deals, we’re now starting to question the profitability of this type of event. With Black Friday being a commercial norm, Brown Thursday (Thanksgiving day) and Cyber Monday (Monday after Thanksgiving) are rapidly being seen as just another leg to this madness.

![Traditions turned financial fluctuations]() Walmart

Walmart

This massive company is an infamous example of Black Friday hysteria. Having had deaths during their sales in the past due to stampedes of people, Walmart has continued to expand what was originally a Friday sale to a continuous sale starting Thursday at 6pm (in most stores).

Let’s tally up all the costs associated with putting Black Friday (Brown Thursday and Cyber Monday) into action:

- Employee’s hourly pay (and potential overtime)

- Manager compensation

- Product stock and inventory

- Crowd control training

- Security to help manage crowds

- Electricity of buildings, lights, and registers

- Food for staff (Thanksgiving dinner for employees)

- Time to price each SKU profitably

- Liability insurance (in the case of casualties)

With all of these extreme sales, companies like Walmart have been able to stay profitable as this “holiday” has grown into a giant. One of the major factors that go into that is inventory. By acquiring a large amount of inventory, you minimize the cost per item and thus create a more profitable ticket item.

Putting Black Friday into production is not cheap. In addition to all of the above, the most important thing is to make sure your products are being priced for profit. Profitability is the number one thing that you need to keep in mind, as you have a responsibility to company stakeholders.

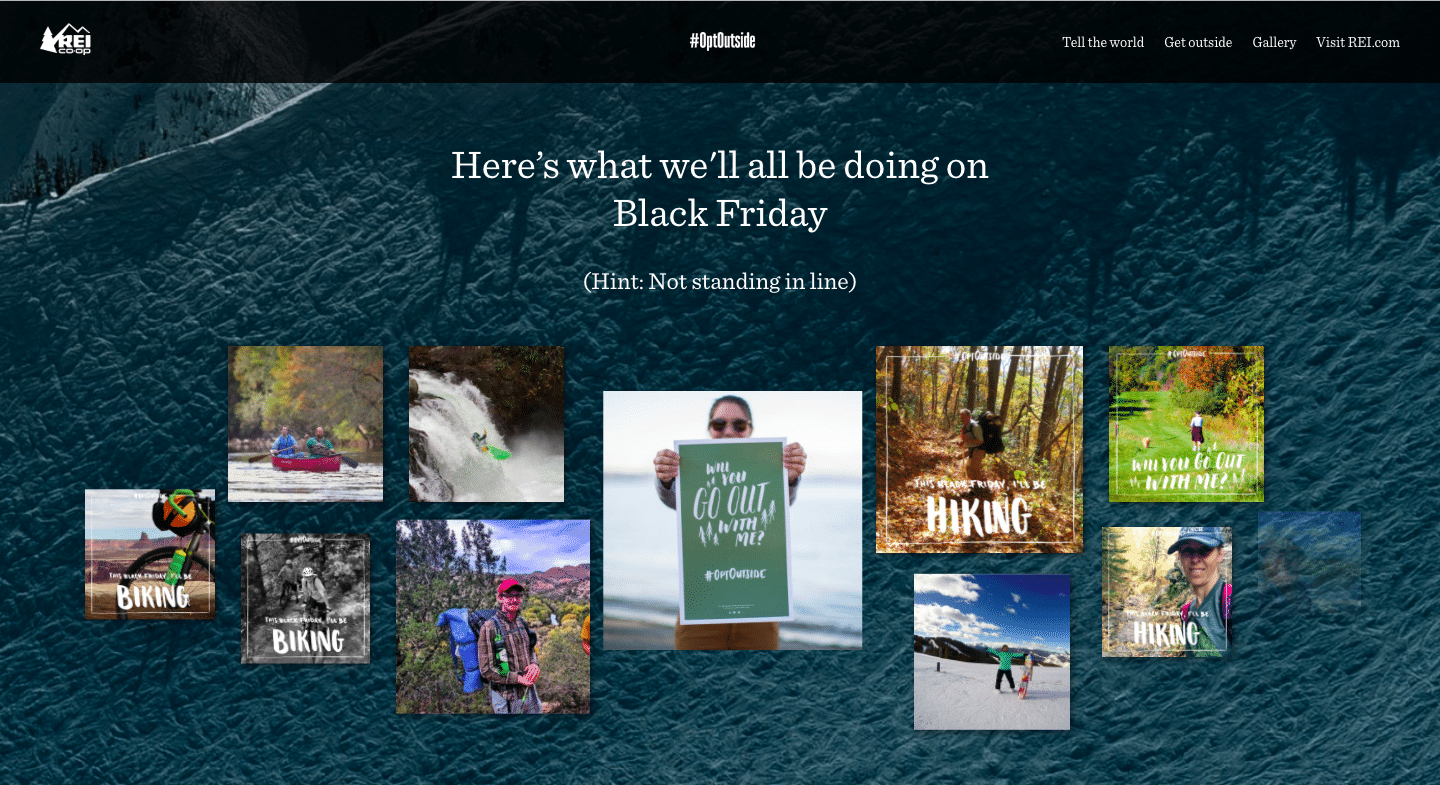

R![Traditions turned financial fluctuations]() EI

EI

By contrast, REI, an outdoor recreational equipment retailer, has opted-out of participating in Black Friday festivities. Financially, they may have missed out on a slight increase in revenue.

But the real question is, what’s the best decision to make for your brand? Some decisions to gain more profit while going against values may actually compromise your company and result in a loss. No amount of pricing products for profit can counteract any decision that is against the brand.

#OptOutside has been a movement that aligns with REI’s mission and vision. They are able to maintain their customer base and grow year over year without offering the Walmart-style sales. This tradition has smoothed over typical retail sales cycles.

One of the main differences between Walmart and REI comes down to the price difference on their products. REI sells higher quality, more expensive, and sustainable products. People who are seeking their equipment are not the type of customer that demands cheap products.

[box][highlight]Deciding whether to host a sale throughout out the holidays? Make sure you have priced your products or services for profit. Download the Pricing for Profit Inspection Guide to help you price accordingly and point out areas where you are not currently producing profit. [/highlight][/box]

Seasonal Sales – Good, Bad, or Ugly?

With all things, there’s a good, bad, and ugly side to it; seasonal sales are not excluded from this.

The Good | How it Helps Businesses

Seasonal sales help businesses around the country and the world. Projections can be easier when a company knows when its sales will peak and decline.

Start by creating a yearly plan. If your company does not do anything besides one big day, analyze typical sales and cross-analyze them with your goals. How are you going to survive the gap?

Offer Other Products/Services

There are many options to subsidize a limited season. Offer those products or services that are popular in-season to another target market. Another option is to create other seasonal sales within the calendar year.

For example, a company that puts up Christmas lights in October-December will find that their off-season takes up the majority of the year. This provides an opportunity for you to adapt. This particular company uses their same inventory (Christmas lights) to do wedding decorations in the April-August months. While it does not completely match the winter sales, they are able to keep up the cash flow throughout the year.

The Bad | How it Hurts Businesses

With all things good come bad. Traditions turned financial fluctuations are not exempt from the bad.

External Dependencies

Depending on one single event, such as Black Friday, for the majority of your yearly sales, is a risky affair! If something externally occurs before or during said sales event, the entire event could be disastrous. But for some companies, that’s all they have.

If you find yourself in this position, it’s time to start finding other sales methods that do not heavily rely on one-time events surrounding holidays, etc.

Staffing: On-boarding & Overtime

It’s often said that a company spends most of its money on people. Seasonal sales only expands these issues. With these financial fluctuations, companies hire seasonal employees. Training, on-boarding, monitoring, salary (typically hourly for retailers), over-time compensation, and any other forms of employee care are just a few factors that hurt businesses if not managed carefully.

The Ugly | Seasonal Cash Flows

Seasonal cash flows are difficult to project and track. This is one of the really ugly parts of having high financial fluctuations.

Price for Profit

Even though Black Friday is in a few days, prepping for seasonal sales are still underway with the holiday season coming quickly. Easily discover if your company has a pricing problem, and learn how to fix it by downloading the Pricing for Profit Inspection Guide.

[box]Strategic CFO Lab Member Extra

Access your Strategic Pricing Model Execution Plan in SCFO Lab. The step-by-step plan to set your prices to maximize profits.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]

History of Thanksgiving

History of Thanksgiving Walmart

Walmart

EI

EI