Entrepreneurs (typically from a sales or operational background) and CFOs/Controllers (financial function) see this issue in completely different lights. But let’s get into the very definition of inconsistent revenue streams.

What is an “inconsistent revenue stream”?

An inconsistent revenue stream occurs when your product and/or service is not able to consistently provide a reliable revenue number to use for projections. One month you may sell 43 widgets while in the next month, you sell 2. This causes some serious problems with putting together sales projections, annual budgets, operational decisions, etc.

The problem with inconsistent revenue streams is that a lot of entrepreneurs survive off the “pops” — those moments of big return, when a calculated investment finally pays off, the moment when you land a big fish that has big business to offer you, the moment when you get a “Win.” But these are conditional occurrences that are inconsistent, sometimes unexpected, and may be dependent on a particular sales person, economic climate, or a referral based on your connections.

![]() Destroyer of Value

Destroyer of Value

Investors look at inconsistent revenue streams the same way they would look at a company that has made no sales in 3 years. It’s worthless to them from a predictive standpoint. Investing in a company with inconsistent revenue streams comes with high risk and questionable return. An investor that looks at a company that only survives off of those “pops” (that get entrepreneur’s blood rushing) will likely run far far away.

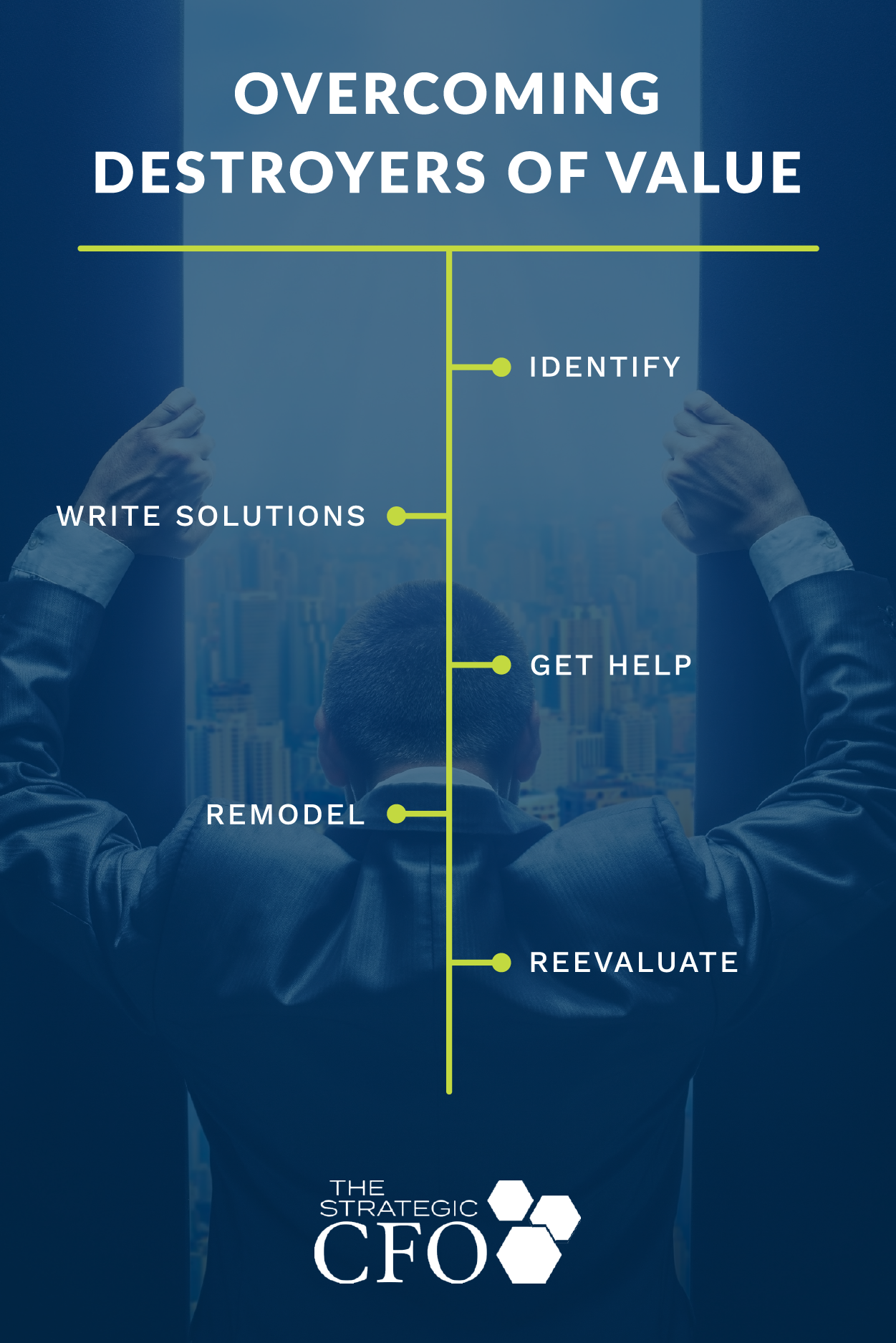

This type of inconsistency is what we call a “destroyer of value”.

[highlight]To improve the value of your company, identify and find solutions to those “destroyers” of value. Click here to download your free “Top 10 Destroyers of Value“.[/highlight]

Identification of the Destroyer

It’s often said, if you can’t admit you have a problem, then you can’t solve the problem. The first major task is to identify if you have this particular destroyer in your company. There are a couple of things that you can look for. If you experience any of the following, the value of your company might be less than you would like:

- Decreases in sales that aren’t reflective of economy

- Surviving on the cash you made during a large sale

- Extreme differences with month-over-month sales

- Dependency on one or two sales persons

- Reliance on a particular person or company for leads

- A specific and narrow market that purchases in bulk only every so often

Whatever the signal is, identify it and write it down.

Solutions for the Destroyer

Instead of waiting for the stars to align, smart owners increase business value through the creation of a smaller, consistent revenue streams. This typically means a monthly payment from a wider audience. You might have a monthly membership with access to helpful content or you might have monthly, recurring work where businesses have contracted you for a lengthier amount of time at a discounted rate.

Creating a recurring revenue stream means consistent cash flow and a business that is less affected by change. Instead of relying on one big fish or several “pops,” these owners cast a wider net to obtain many little fish that are constantly putting food on the table.

You’re in a business with customers. These customers have needs. Find a way to consistently meet your customers’ needs. Add value to their lives, at a rate they feel is fair and unobtrusive, and you’ll end up with a higher and more consistent cash flow that a buyer will be willing to pay you top dollar for.

Reliable Revenue Streams

The main way to ensure that your company can consistently have revenue is to modify your revenue stream. Answer the basic questions: 1) how easily can you track and predict future months’ revenues? 2) who are your customers? 3) why are they buying your product more than once?

Recurring Subscription Model

From the customer’s point of view, a subscription for a product or service saves the customer time and hassle. What a lot of companies fail to realize is, subscription models for businesses provide value for the customer and the company.

Because a subscription model has high recurring revenue, a business has the ability to calculate the inventory, lifetime value of a customer, and options for promotional offers. According to John Warrillow, the creator of the Value Builder system, a business with a subscription model’s value “will be up to eight times that of a comparable business with very little recurring revenue.”

[box][highlight] As you calculate your net present value, make sure there aren’t any other “destroyers” that could decrease the value of your company. Download your free “Top 10 Destroyers of Value“.[/highlight][/box]

Other revenue streams

Other revenue models such as rentals, usage fees, freemium, and licensing are just a few more examples of reliable revenue streams. What do they all have in common? Convenience and consistency.

Conclusion

Don’t limit your business to the simple commercial and retail business. Choose the one that works well for your business and is predictable. Work smarter, not harder.

(Download the Top 10 Destroyers of Value to maximize the value of your company. Don’t let the destroyers take money from you!)

[box]Strategic CFO Lab Member Extra

Access your Cash Flow Tuneup Execution Plan in SCFO Lab. This tool enables you to quantify the cash unlocked in your company.

Click here to access your Execution Plan. Not a Lab Member?

Click here to learn more about SCFO Labs[/box]

Destroyer of Value

Destroyer of Value